The purpose of this program is to encourage “substantial” rehabilitation, redevelopment, development, infill and intensification projects by providing a financial incentive that reduces the property tax increase that can result from these various types of

development.

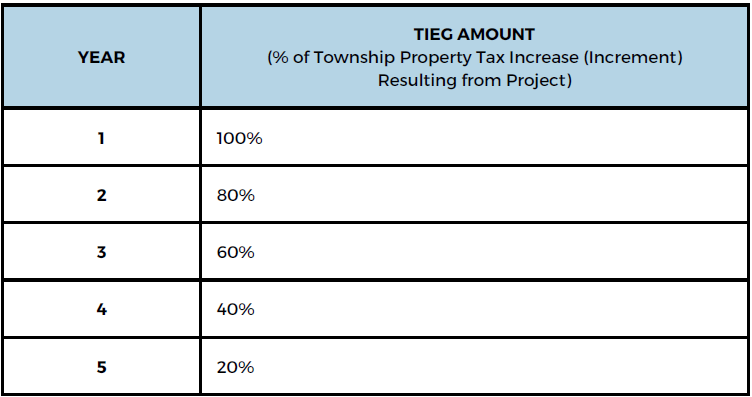

This program will provide an annual tax increment equivalent grant (TIEG) for five years after project completion equal to a percentage of the increase in the Township portion of property taxes as shown below generated by completion of a “substantial project” where the proposed and “as built” substantial project achieves the minimum evaluation

score specified in the TIEG Program.

In order to be eligible for final approval of a TIEG by the Township, both the “proposed” and “as built” project contained in an application for the TIEG Program must achieve a minimum score when evaluated against the TIEG Program Evaluation Framework.